Inflation is falling. This is great news for investors, as it means the Bank of England can stop raising interest rates soon. Historically, a peak in interest rates has been a springboard for equity and bonds markets to move higher. You tend to see substantial market gains in the three years post-peak rates.

Multi-Asset Solutions, which have a mixture of asset classes, mainly equities and bonds, tend to benefit from this shift in focus by central banks.

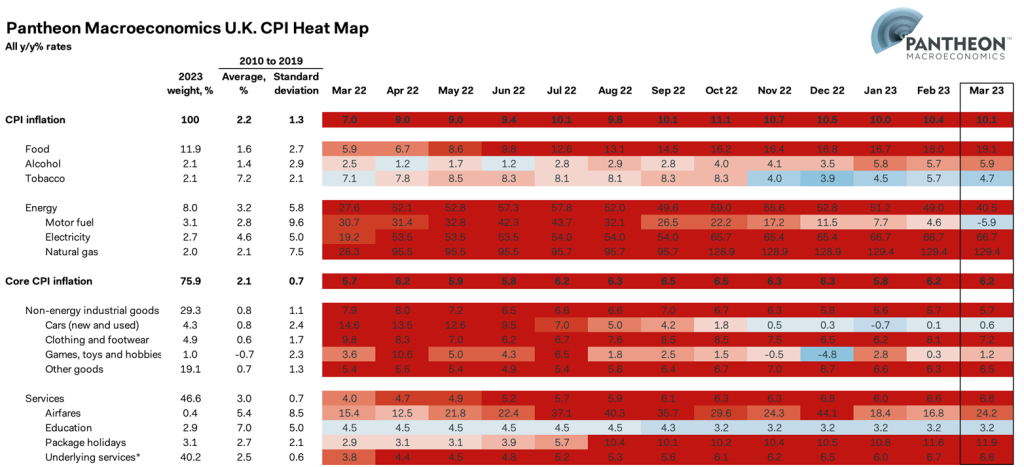

However, many people, including the Bank of England, will be disappointed that inflation remains stubbornly high. The heatmap shows that a sharp fall in motor fuel CPI inflation was the primary driver of the fall in the headline rate. However, food inflation rose again; poor harvests in southern Europe and North Africa appear to be to blame for a spike in the cost of fresh food. The stark reality is that many people are struggling, due to the pressure of higher prices.

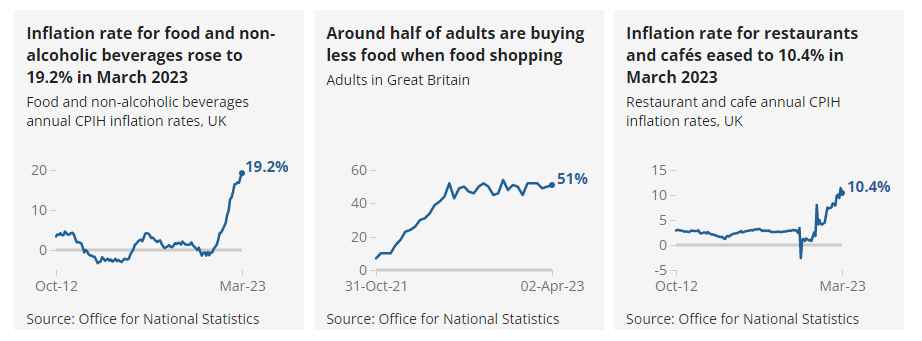

A recent survey by the Office of National Statistics laid bare the plight of consumers. The prices of food and non-alcoholic drinks rose at the fastest rate in more than 45 years in the 12 months to March 2023. The annual inflation rate in this category was 19.2%, up from 18.2% in the year to February 2023.

To see a higher figure, you have to go back as far as August 1977, when it was estimated to be 21.9%. The largest contributor to the rise in food inflation was bread and cereals, for which average prices rose by 19.4% in the year to March 2023.

Prices are also rising in restaurants and cafés, where the annual inflation rate was 10.4% in the year to March 2023, although that was down slightly from 11.4% in February 2023. As the cost of food continues to rise, half of the adults in Great Britain are buying less food when food shopping.

When asked between 22 March and 2 April 2023, 51% of adults reported buying less food in the previous two weeks. The survey also reveals around one in four adults (26%) experienced shortages of essential food items in the past two weeks. This is a real problem.

This is where the Bank of England comes in. They will act, and are now expected to raise interest rates by 0.25% in May to help bring down inflation, which will put in place the foundation stone for the springboard.

However, this is not going to help in the short term, as higher mortgage costs are the last thing cash-strapped consumers need.

Nonetheless, there is good news in sight.

The pace of inflation is coming down – prices are still rising, but a bit less rapidly. And you can expect a more significant drop next month due to “base effects”. The big jump from March to April 2022 was substantial, as energy prices spiked materially due to the invasion of Ukraine. It will be far more subdued between March and April 2023.

For some perspective on this, between March and April 2022, CPI inflation jumped by 2.5%. That was by far the highest monthly increase in data going back to the start of 1998. In fact, during that period, we’ve only ever had four monthly readings of more than 1%: 1.1% to October 2021, 1.1% to March 2022, the aforementioned 2.5% to April 2022, and 2% to October 2022. The two latter monster jumps were due to changes in Ofgem’s energy price cap, so were somewhat artificial in nature.

As a reminder, electricity and gas prices rose 52% month-to-month in April 2022. Clearly, that won’t be repeated between March and April 2023. That means that if the overall price index stayed flat between March and April 2023, annual CPI inflation will fall to around 7.4% purely on base effects.

Takeaway: Inflation figures will continue to fall this year, and almost certainly won’t be in double-digits next month.

Did you know: Netflix said it would roll out new password-sharing limitations more broadly – including in the US – by the end of June, and announced it would soon wind down the DVD-by-mail business that the company was built upon. Click here.

Source: Marlborough Multi-Asset Investment Team, Patheon Macroeconomics, Office for National Statistics, Bloomberg (John Stepek).